A Powerful Lesson from Estate Planning

As parents, we often shield our children from difficult topics, believing we’re protecting them. However, one of our clients recently shared a touching story that challenges this notion and highlights the unexpected benefits of open conversations about death and estate planning.

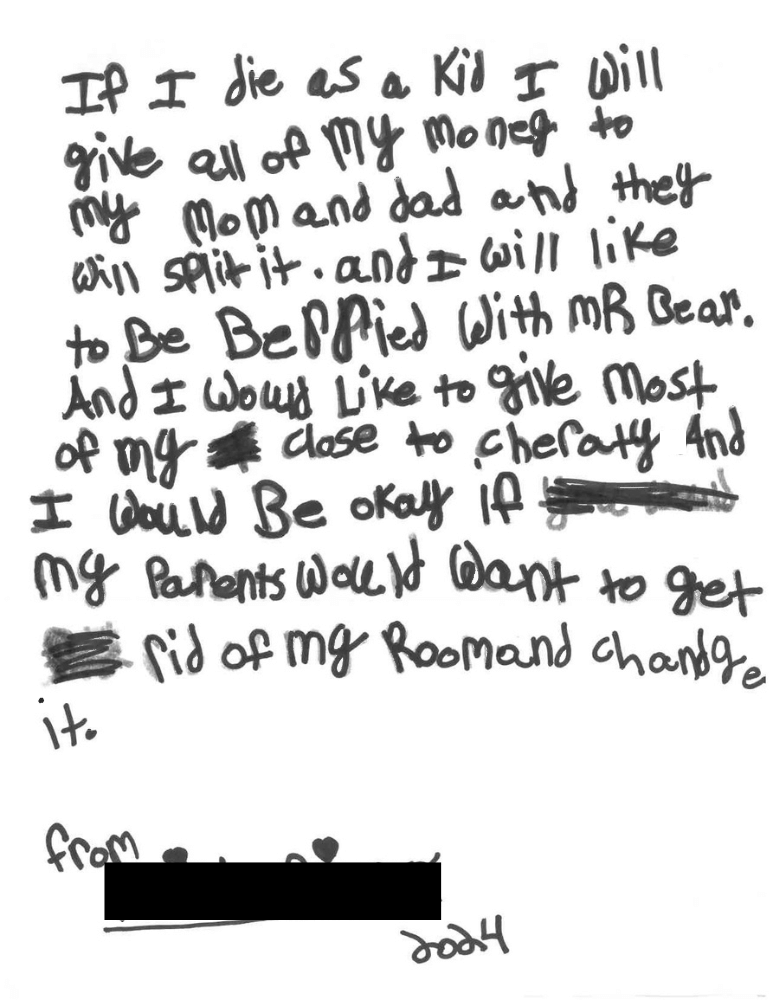

A Nine-Year-Old's Will: Wisdom Beyond Her Years

Our client, a mother of a nine-year-old girl, recently shared a touching story that beautifully illustrates the unexpected benefits of open conversations about death and estate planning. Using her own estate plan as a starting point, this mother bravely broached the subject of mortality with her daughter. The outcome was both surprising and deeply moving.

Inspired by their conversation, the young girl took it upon herself to write her own Will. Her handwritten document reads:

This simple yet profound document reveals several insights into a child’s understanding of death and legacy:

- Financial Consideration: The girl’s decision to leave her money to her parents shows an understanding of financial matters and a desire to care for her family.

- Emotional Attachment: Her wish to be buried with “mR Bear” demonstrates the importance of comfort objects, even in death.

- Altruism: The desire to donate her clothes to charity reflects a developing sense of social responsibility and generosity.

- Empathy: By giving permission for her parents to change her room, she shows remarkable consideration for her parents’ emotional needs after her hypothetical passing.

- Acceptance: The matter-of-fact tone suggests a level of acceptance about death that many adults struggle to achieve.

This heartwarming document shows that children, when given the opportunity, can grasp complex concepts like legacy, generosity, and the finality of death. It also highlights the potential for profound family discussions that can arise from estate planning.

Moreover, this young girl’s Will serves as a powerful reminder of the importance of having these conversations early. By demystifying death and estate planning, we can help our children develop a healthy understanding of these inevitable life events. This understanding can foster resilience, empathy, and a sense of responsibility that will serve them well throughout their lives.

As estate planning professionals, we’re continually amazed by the wisdom children can display when given the chance to engage with these important topics. This nine-year-old’s Will is a testament to the potential for growth, understanding, and even a touch of humor that can emerge from open, honest conversations about death and legacy.

Understanding Death: A Developmental Journey

Children’s comprehension of death is a complex process that evolves as they grow and develop cognitively and emotionally. This journey is unique for each child, influenced by their experiences, cultural background, and emotional development. However, there are general patterns in how children at different ages tend to understand and process the concept of death.

Infants and Toddlers (0-2 years)

At this age, children have no real concept of death. However, they can sense changes in their environment and routines, which may lead to increased crying or changes in sleeping and feeding patterns. While they don’t understand death, they do react to separation from parents and caregivers.

Preschoolers (3-5 years)

Children in this age group begin to gain awareness of death, but their understanding is limited:

- They often view death as temporary or reversible, similar to what they see in cartoons.

- They engage in “magical thinking,” sometimes believing their thoughts or actions caused the death.

- They may ask repetitive questions about death as they try to process the concept.

- They don’t fully grasp the permanence of death and may expect the deceased to return.

At this stage, it’s crucial to use clear, honest, and simple language when explaining death. Avoid euphemisms like “passed away” or “gone to sleep,” as these can cause confusion.

Early School Age (6-8 years)

As children enter this stage, their understanding of death becomes more sophisticated:

- They begin to grasp that death is permanent and irreversible.

- They may become more anxious about their own and others’ health and safety.

- They start to understand that death is an inevitable part of life that happens to all living things.

- However, they may still personify death (e.g., as a ghost or grim reaper).

Children at this age may need help expressing their emotions and understanding that the death wasn’t their fault.

Who will take care of your kids if something happens to you?

Pre-adolescents (9-12 years)

By this age, children usually have a more mature understanding of death:

- They comprehend the finality of death and that the deceased won’t return.

- They may show increased interest in the biological and medical processes of death and dying.

- They become more aware of the long-term implications of a death, such as missed milestones or events.

- They may grapple with more existential questions about life and death.

At this stage, children benefit from open, honest discussions about death. They may also appreciate opportunities to participate in memory-making activities or sharing stories about the deceased.

Adolescents (13-18 years)

Teenagers generally understand death similarly to adults, but they may struggle with the emotional aspects:

- They fully grasp the permanence and universality of death.

- They may become preoccupied with their own mortality or the possibility of losing loved ones.

- They might grapple with philosophical or spiritual questions about the meaning of life and death.

Throughout all these stages, it’s important to remember that every child is unique. Factors such as previous experiences with death, cultural and religious beliefs, and individual emotional development can all influence how a child understands and copes with death. Providing honest, age-appropriate information, encouraging questions, and offering emotional support are key to helping children navigate this complex topic at any age.

The Power of an Estate Plan: More Than Just Documents

An estate plan is far more than just a binder collecting dust on a shelf. It’s a powerful, living tool for protecting your children and providing them with peace of mind, both now and in the future. Here’s how a comprehensive estate plan can make a significant difference in your family’s life:

1. Long-Term Guardianship

Designating long-term guardians is one of the most crucial aspects of your estate plan. This ensures that if you’re unable to raise your children to adulthood, they will be cared for by people you trust implicitly. These guardians are individuals who:

- Share your values and parenting philosophy.

- Have the emotional and financial capacity to raise your children.

- Are willing and able to take on this significant responsibility.

By carefully selecting and legally designating long-term guardians, you provide your children with a sense of security and continuity, knowing they’ll always have a loving home, even if the unthinkable happens.

2. Short-Term Guardianship

Often overlooked but equally important is the designation of short-term guardians, also known as “Emergency Responders.” These individuals play a critical role in your children’s immediate safety and well-being in case of an emergency. They are:

- People who live nearby and can quickly respond in an emergency.

- Trusted individuals who your children know and feel comfortable with.

- Legally appointed to care for your children until your long-term guardians can arrive.

This arrangement ensures that your children will never be in the care of strangers or DCF (Massachusetts’s Department of Children and Families), even temporarily. It provides an immediate safety net, giving you and your children peace of mind that they will always be in loving, familiar hands.

3. Financial Protection

A well-crafted estate plan goes beyond just passing on assets; it creates a framework for your children’s financial future. This includes:

- Ensuring financial continuity so your children’s lifestyle and opportunities aren’t disrupted.

- Setting up trusts or other financial vehicles to manage and protect your children’s inheritance.

- Appointing trusted individuals to oversee your children’s finances and make sound financial decisions on their behalf.

By addressing these financial aspects, you help alleviate your children’s potential stress about an uncertain future. They can feel secure knowing that there are specific plans and people in place to guide them as they grow up.

4. Legacy

At The Parents Estate Planning Law Firm, we believe your estate plan is a powerful tool for preserving and passing on your legacy. It’s not just about tangible, material possessions, but about your values, hopes, and dreams for your children. This can include:

- Recording your life stories, lessons, and advice.

- Outlining your values and the principles you hope your children will embrace.

- Creating mechanisms to support your children in pursuing education, careers, or other goals you value.

By thoughtfully crafting this aspect of your estate plan, you ensure that your influence and guidance continue to shape your children’s lives, helping them feel connected to you and your family’s legacy long into the future.

5. Open Communication

Perhaps one of the most valuable aspects of creating an estate plan is the opportunity it provides for open family discussions. Using your estate plan as a conversation starter can:

- Foster trust and openness within your family

- Create a safe space for your children to express their fears and concerns about the future.

- Help your children understand your values and the reasoning behind your decisions.

- Encourage ongoing dialogue about important life topics.

These conversations, facilitated by the estate planning process, can strengthen your family bonds and provide a foundation of trust and understanding that will serve your children well throughout their lives.

A comprehensive estate plan is a dynamic tool that does far more than distribute assets. It provides protection, guidance, and peace of mind for your children, ensuring that your love and care for them extends far into the future, regardless of what life may bring.

Taking Action: Protect Your Family Today

If you haven’t created a comprehensive estate plan, or if your current plan needs updating, now is the time to act. Our team at The Parents Estate Planning Law Firm is ready to help you craft a plan that not only protects your assets but also serves as a foundation for important family discussions.

Schedule a planning session with one of our attorneys today. Let’s work together to create a legacy of protection, understanding, and peace of mind for your children.

Remember, an estate plan is more than just legal documents – it’s a tangible expression of your love and commitment to your family’s future. Don’t wait to have these crucial conversations with your children. They may surprise you with their wisdom and resilience, just like our client’s daughter did.