You are about to be a new parent! As you prepare to welcome your little one, it’s important to consider how you’ll protect your growing family’s future. At The Parents Estate Planning Law Firm, we understand that estate planning might not be the first thing on your mind, but it’s an essential step in securing your child’s future. Let’s explore the key differences between Wills and Trusts, and why they matter for new parents.

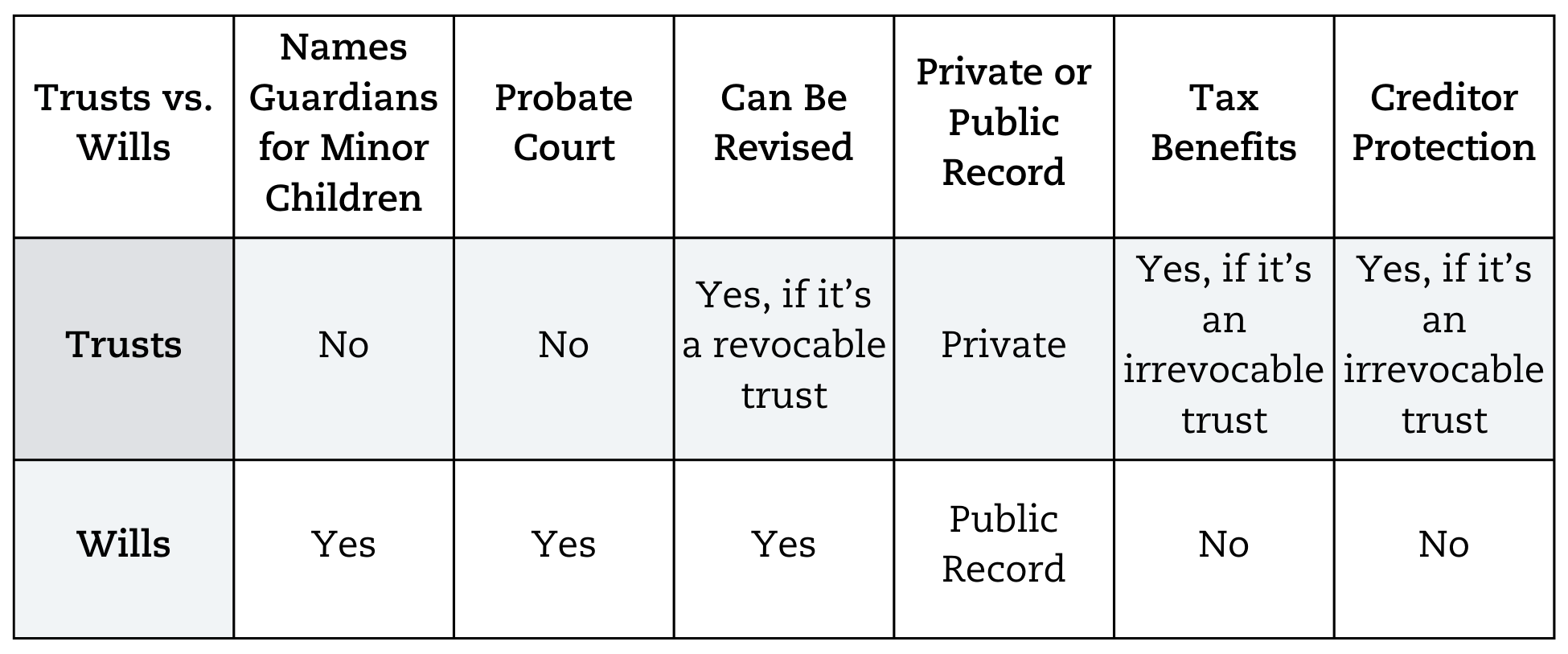

Wills vs. Trusts: The Basics

Wills:

- A legal document that takes effect after you pass away

- Directs how your assets should be distributed

- Allows you to name guardians for your child

- Must go through probate, a public court process

Trusts:

- A legal entity that can take effect immediately

- Holds and manages assets for beneficiaries

- Can provide ongoing asset management for your child

- Avoids probate, offering privacy and potentially faster distribution

When They Take Effect

For expecting parents, this is a crucial consideration:

Asset Coverage

Guardianship and Asset Management

Both wills and trusts allow you to name guardians for your child, but they differ in how assets are managed:

Wills can name long-term guardians and specify how assets should be distributed, but they don’t provide ongoing asset management. Once your child inherits, the assets are typically given to them outright at age 18 or 21.

Trusts offer more control. You can name a trustee to manage assets for your child’s benefit until they reach an age you specify. This can be particularly important for expecting parents who want to ensure their child’s inheritance is responsibly managed into adulthood.

Who will take care of your kids if something happens to you?

Privacy and Probate

Wills must go through probate, a public court process that can be time-consuming and expensive. This means your family’s financial matters become part of the public record.

Trusts avoid probate, offering privacy and potentially faster distribution of assets. For new parents, this can mean less stress and more immediate support for your child if something happens to you.

Costs and Complexity

Which is Right for Your Growing Family?

Every family’s situation is unique, and the choice between a will and a trust depends on your specific circumstances and goals. However, many expecting parents find that a combination of both – a pour-over will and a revocable living trust – offers the most comprehensive protection for their growing family.

At The Parents Estate Planning Law Firm, we specialize in helping expecting parents create estate plans that grow with their families. Our Planning Session is designed to help you understand your options and create a plan that provides the best possible protection for your child.

Don’t wait until after your baby arrives to start this important process. Contact us today to schedule your Planning Session. Let us help you take this crucial step in preparing for your new arrival and securing your family’s future.