Becoming a parent is wonderful and messy. It’s full of firsts – first smile, first laugh, first blow-out diaper. When your baby comes into the world, you expect these experiences, as you should! The first plan most parents implement is around sleep schedules. Whether for yourselves or your child, sleep is important and deserves to be prioritized. New parents should also prioritize estate planning, as you’ll discover while we help answer the question, “What does estate planning mean for new parents?”

Your "New Parents" Guide to Understanding Estate Planning

If something happens to you, comprehensive legal planning prevents:

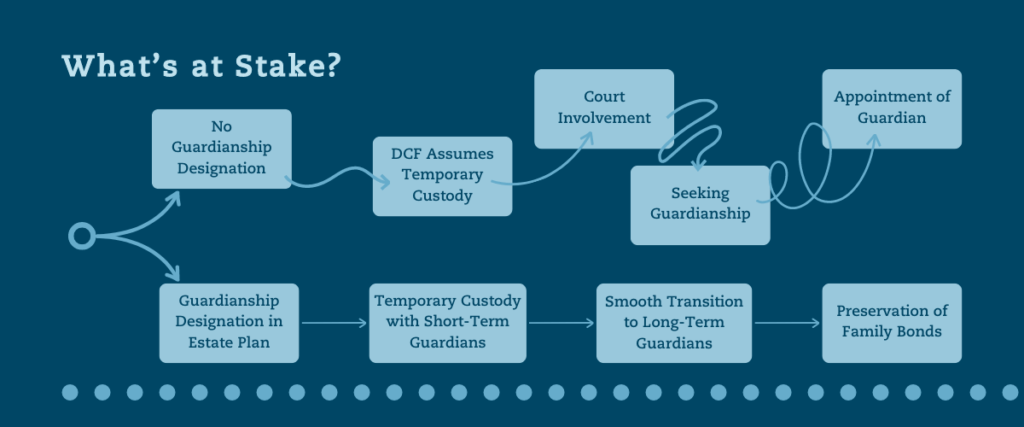

- Your newborn placed in the care of the Department of Children and Families. (This can happen even if you have a will and living trust. It would likely be temporary, but you would never want your baby in the care of strangers – ever.)

- Someone you would never choose could end up charged with the custody and care of your child.

- A Judge deciding who will raise your baby – someone who doesn’t know you, your family, or other important people in your family’s life.

- Your family fighting over custody for your child, potentially challenging the guardians you’ve already designated.

- Losing tens of thousands of dollars to the probate process that ties up your money, depriving your child of necessary resources.

- Bad actors who take advantage of child inheriting money when they turn 18.

Protecting Your New Family

With your new baby comes a new network of relationships. Immediately, that will mean family (if you’re lucky enough to live close by), babysitters, neighbors, and daycare teachers. Do these people know what to do if something happens to you?

Take your babysitter, Zoey. Now Zoey probably wouldn’t know if something happened to you and your spouse. She would know when you said you’d be back from movie night – let’s say 11:00 PM. Come 1:00 AM, she would not only be worried, but her parents would be worried, too. Either Zoey or her parents are going to call the police. And this call is what triggers all those unwanted happenings we listed earlier.

Step 1: The Foundation of Estate Planning – Creating a Will

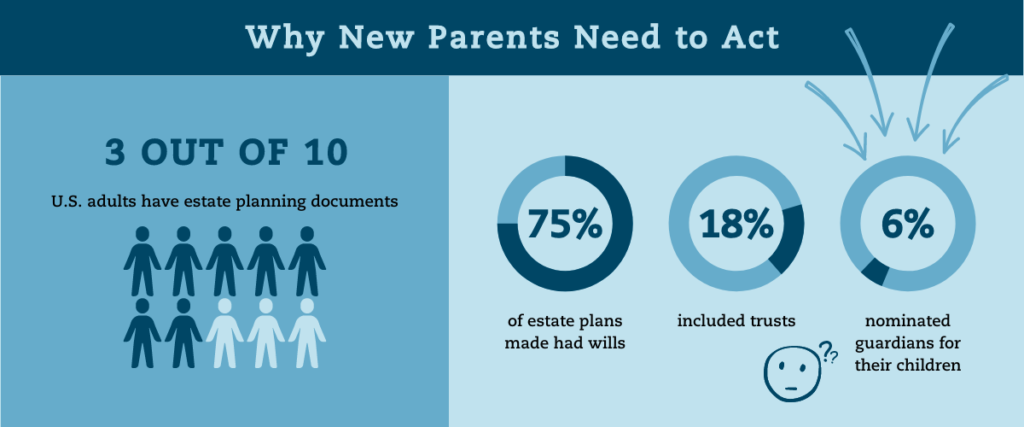

Every parent needs a will. Especially parents with minors. That’s because your last will and testament is where you would appoint guardians for your child. We cannot stress enough how critically important it is for parents to designate guardians. We also think your will should be a simple document within a more robust estate plan.

Here’s what your will should include:

Long-Term Guardians

This is the traditional type of guardianship most people think of. Long-term guardians are the people who would care for your child in your stead. You should trust your long-term guardians to raise, love, and guide your child until they are 18 years old.

Remember to consider alternates, especially for these scenarios. Say your #1 pick for long-term guardians are your sister Monica and her husband Greg. What happens if they get divorced, or your sister dies? Would you want only Monica to have custody, or would you prefer your beloved friends Jenny and Liam to have custody instead?

Short-Term Guardians

Traditional estate plans are not going to account for this paramount category of guardianship. Short-term guardians are put in place for those circumstances where your long-term guardians are not immediately available.

These are your first responders – the people who prevent your child from ending up in the hands of strangers! They should live within 15-20 minutes of you so they can come over quickly to either stay with your child or bring your child to their home, at least until the long-term guardians arrive.

If you think about it, there are plenty of things that could prevent long-term guardians from being immediately available in the way short-term guardians can. They might be on vacation (potentially in another country), live in another state, or, if they live more than 20 minutes away, they could get stuck in traffic. Watch this video to learn more about the difference between long-and-short-term guardians.

Our previous suggestion to consider alternates applies here, too. We also suggest you name as many short-term guardians as possible to increase the chances that the right person is available at the right time.

Executor

Executor is a job that involves managing your assets during the probate court process. Even though a comprehensive estate plan should effectively keep your family out of court, it’s still a good idea to name the executor. It’s better to have someone you know and trust in charge of any decisions that need to be made, rather than someone appointed by the court.

Can You Prevent Certain Family Members From Becoming Guardians?

Step 2: Ensuring Financial Security – Life Insurance and Beneficiaries

Not everyone needs life insurance. But as new parents, this protection is worth talking about.

Life Insurance for New Parents

Briefly, life insurance is a contract that benefits your family with a cash payout after your death. It’s not beneficial for everyone but could be an important asset that “…provides tax-free money to surviving spouses…or guardians and children” (Investopedia).

Not all our clients have life insurance, and that’s ok. Sometimes the cost of premiums outweighs the potential benefit. If you already have a life insurance policy, you and your spouse should consider adding your child as a rider to your policy. It’s typically low cost and worth discussing with your insurance agent.

Beneficiary Designations

As your new family continues to grow, it’s important to update beneficiaries on your current policies. Though this may seem straightforward (hello, spouse and child!), naming beneficiaries the right way can avoid headaches down the road.

Here are some things not to do:

- Do not directly name minors. This can complicate matters since your child can’t directly inherit funds until they are 18 years old. We suggest naming your trust instead.

- Do not overlook contingent beneficiaries. Though we all hope our children will far outlive us, this is not always the case. Naming contingent beneficiaries prevents unintended distributions.

- Do not forget about special needs considerations. If you have a beneficiary with special needs, you should consider that direct inheritance could disqualify them from government assistance. We suggest naming a special needs trust instead.

- Read our full article “Mistakes To Avoid When Naming Life Insurance Beneficiaries” to learn more.

Is Name Beneficiaries For Your Life Insurance Enough?

Step 3: Advanced Estate Planning – Trusts and Powers of Attorney

As you may have noticed, we’ve alluded to trusts throughout this article. That’s because we believe trusts to be a foundational element to a comprehensive estate plan for new parents. Trusts come with a litany of estate planning benefits, like avoiding probate, assigning trustees to manage wealth for your minor child, and enacting customizable protections for your child once they inherit. “A trust also gives you more control over how your property is distributed” (The Balance).

Revocable Trusts

This is the most common trust we suggest when estate planning for new parents. It is used while you are alive, and it can be amended or even terminated (as long as you are considered competent). You can change beneficiaries, withdraw or add assets, or change stipulations at any time.

When you create as revocable trust, you are the grantor and the trustee. That means you also manage and invest assets “owned” by the trust. “Owned” is air-quoted because the trust doesn’t technically “own” anything – as the grantor and trustee, you are still the owner.

One thing to note: even though a trust will avoid probate, there is still the matter of estate taxes. In Massachusetts, your first $2 million per person (that’s $4 million for married couples) is exempt from the state’s estate taxes. That seems like a lot of money, but Massachusetts still has one of the lowest thresholds in the entire United States. There are ways to protect more of your assets from the estate tax penalty by using more complicated trusts.

In Massachusetts, none of this matters unless you fund your trust. Click here to learn more about what this is and why it’s important.

Irrevocable Trusts

Typically, when your child inherits your revocable trust, it becomes an irrevocable trust. This means that the new grantor (your child) is not able make any of the changes you were able to make.

Irrevocable trusts have more complex structures so they can add extra protections. One of the primary protections trusts offer is preventing your child from receiving a lump sum inheritance at 18-years old. Think about yourself at 18. Were you making the best financial decisions? What about at 25, fresh out of college, with limited life experience (at least financially speaking)?

When you’re a new parent, you don’t know who your child will grow up to become. You don’t know how wise or cautious they will be, or how easily influenced by others. You can easily reference your own life for where you could’ve used better financial guardrails and provide those to your child through your trust.

For example, you can require a trustee to manage and distribute funds until your child reaches, say, 27 years old. You can specify what those funds are used for, like college or trade school, a modest down payment for a home or car, or starting a business. You can also add rules to protect your child’s inheritance from creditors or divorce.

Privacy is the trust protection that helps me, as a new parent, sleep peacefully. Probate is a public court. Without this protection, all your assets that your child will inherit are public knowledge. What else is public: your child’s name, address, and birthdate!

It is reprehensible, but there are unscrupulous people who regularly visit probate court websites looking for minors with an inheritance on the way. These people, armed with personal information, can then plan how they will befriend and manipulate orphaned kids out of their inheritance.

You don’t have immediate control over how probate court handles public documents concerning minors. This happens by default. What you can control: creating a comprehensive estate plan that includes a trust with protections for the little person that matters to you most.

Protect your children with 5 simple documents

Don’t risk your family’s safety. Discover the essential legal documents every parent needs.

Durable Power of Attorney

Durable power of attorney is a document that financially protects you and your loved ones if you don’t die but are merely incapacitated.

Incapacity means you can’t make decisions for yourself. Getting into an accident, a surgery gone wrong, or clinical diagnosis can result in incapacity. The trouble here is, you’d need help fulfilling your responsibilities.

So, what does this essential estate planning document mean for new parents? It means your bills will continue to be paid on time. It means your mail will be picked up, opened, and answered. It means someone you trust can access your safe-deposit box if needed. You know, the routine things that need to get done so life doesn’t spiral out of control.

Step 4: Navigating Healthcare Decisions – Advance Directives

If you’ve already had your child, you (or your pregnant spouse) likely signed a HIPAA authorization form and assigned at least one health care proxy. That’s because birthing humans is a risky medical event.

If something goes wrong, your medical team needs to know who can make important health care decisions if you’re no longer able to. These are sometimes life-or-death decisions that need to be made in the moment, so choosing someone you not only trust but understands your wishes and any underlying conditions is incredibly important.

HIPAA Authorization

In full, the Health Insurance Portability and Accountability Act (HIPAA) is a national standard that protects your medical privacy as a patient. That means, without your consent, your medical history or health information can’t be shared.

Authorizing access to your patient data is important, but not the full picture. You need another document to allow someone to make medical decisions on your behalf.

Health Care Proxy and Advanced Directives

That’s why it’s important to grant access consistently. Whoever you consent to your patient records via HIPAA authorization, you should also assign as health care proxies.

Whoever you choose, you should be able to discuss end-of-life and medical issues with them. They should know your values, your wishes, and be prepared to advocate for you if disagreements arise.

Your health care proxies should know if you have advanced care directives. In Massachusetts, you can include personal wishes in your living will, but it’s not legally binding on your doctors. You can record these personal wishes in your living will and share them with your health care proxy. You can also use this tool kit for health care advanced planning from the American Bar Association. Or, better yet, schedule a planning session with one of our attorneys to get started on your comprehensive estate planning.

Can’t My Spouse Make Decisions for Me by Default?

Step 5: Organizing and Protecting Your Assets

We’ve covered the basics for estate planning documents, but what about your stuff? The longer you live, you’ll continue to accumulate physical assets, digital assets, and memories. Here’s how you can use your estate plan to organize and protect your assets to pass down a meaningful legacy.

Physical Assets

As a new parent, you might not have a lot of assets. Maybe you and your spouse own a few checking and savings accounts, a small condo, and you each have retirement accounts. Funding your trust with these assets is the first step in protecting your assets.

As your family grows, your asset collection will grow, too. Just remember to keep funding these assets into your trust! This habit will keep your assets organized if the unthinkable were to happen.

Not all assets are as straight-forward as deeds and accounts. Here are some tips to organize your other physical assets to protect them within your estate plan:

- Create a Comprehensive Inventory: Start by listing all your physical assets, including real estate, vehicles, jewelry, art, collectibles, and any other items of value.

- Appraise Valuable Items: For items of significant value, consider getting an appraisal to document their worth accurately. This is especially important for art, antiques, and collectibles.

- Designate Important Role: Clearly identify and document roles such as the executor of your will, guardians for your minor child, and any specific roles related to the management of your physical assets.

- Secure Important Documents: Store critical documents like your will, trust documents, property deeds, and insurance policies in a safe but accessible place. Inform your executor and trusted family members about the location.

- Consider a Safety Deposit Box: For extremely valuable or irreplaceable items, consider using a safety deposit box. Ensure that your executor or a trusted individual has access to or is aware of its contents.

- Label and Photograph Items: For items that will be distributed according to your will, label them, and take photographs. This can help prevent disputes among heirs.

- Update Your Inventory Regularly: As you acquire or dispose of assets, update your inventory to reflect these changes. This ensures that your estate plan remains accurate and up to date.

Digital Assets

You already have a lot to manage as a new parent, and your digital assets deserve your attention to better organize your estate plan. In this digital age, you’ve likely accumulated hundreds of accounts. These are under your digital ownership and can be just as messy (if not more) to untangle if not properly organized.

This is how you safeguard memories for your children. Even if your social media accounts are your family photo albums, make sure that someone at least knows how to access and maintain your accounts.

We cannot stress enough how important it is to organize your accounts and passwords. Two reasons come to mind.

For one, your estate plan designates a durable power of attorney and executor to manage your finances for different reasons. They will find it difficult to fulfill their obligations without access to your financial accounts.

The other reason involves identity theft. Yes, even after you pass, this is a concern. Proper inventory and security of your accounts can help prevent identity theft. And in the case that it does happen? Your family is better equipped to address the issue quickly.

Your Legacy

One unique and deeply personal feature offered by The Parents Estate Planning Law Firm is the Legacy Interview. This innovative service transcends the traditional boundaries of estate planning by allowing parents like you to capture and preserve your voice, story, values, and wisdom for future generations.

Unlike the tangible assets and financial wealth that are commonly the focus of estate planning, the Legacy Interview focuses on the intangible yet invaluable aspects of your legacy.

The importance of the Legacy Interview for new parents cannot be overstated. In the whirlwind of new parenthood, much attention is given to immediate needs and financial planning for the future. However, the Legacy Interview provides an opportunity to pause and reflect on the broader picture of what you wish to leave behind. It’s about more than just assets; it’s about leaving a piece of yourself for your children and grandchildren.

This recorded interview captures your life stories, your values, your advice, and your hopes for the future, creating a lasting treasure that can be passed down through generations. For new parents, organizing your assets to protect your legacy is crucial, but ensuring your children know who you were and what you stood for is priceless.

We offer The Legacy Interview at all planning levels, emphasizing its fundamental role in the estate planning process. It’s a testament to our team’s understanding that estate planning is not just about the distribution of assets but about preserving the essence of who you are.

As you embark on the journey of estate planning, incorporating the Legacy Interview into your plan ensures that your legacy encompasses both your material wealth and your personal narratives, making it a holistic approach to safeguarding your family’s future.

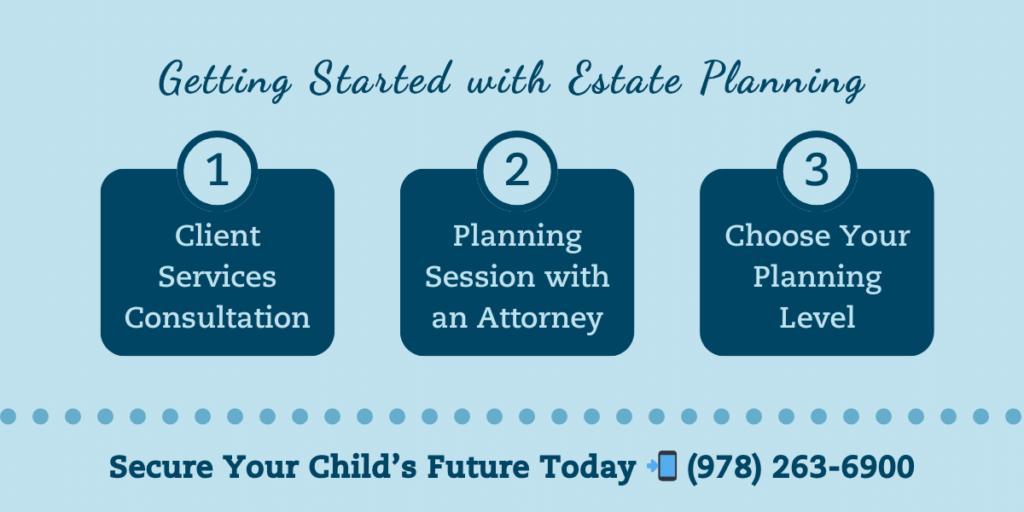

The Role of Professional Advice in Estate Planning

In the realm of estate planning, professional advice is not just beneficial—it’s indispensable, especially for new parents who are navigating this crucial process for the first time. Seeking the guidance of an experienced estate planning attorney ensures that your unique family situation and goals are considered and that your estate plan complies with current laws and best practices.

Professionals can provide clarity on complex issues such as tax implications, guardianship designations, and trust formation, which are often overwhelming without legal expertise. Moreover, they can help you understand the nuances of your state’s laws, which can significantly impact your estate plan.

How Do You Pick an Estate Planning Attorney?

When researching the right estate planning attorney, it’s essential to ask the right questions to ensure they are well-suited to meet your family’s needs.

Our free resource, “10 Things to Ask Before Hiring an Estate Planning Lawyer,” provides questions you can use to qualify estate planning attorneys and get clear on what you want for your family.

You can also check out our blog post, “Top 3 Questions to Ask an Estate Planning Attorney“, for the most important questions to ask while you’re researching.

How long does it take to get an estate plan?

Taking Your First Step Towards a Secure Future

As we’ve explored throughout this blog, estate planning for new parents is not just a matter of financial prudence; it’s a profound act of love and responsibility. It’s about ensuring that your children are cared for, your wishes are honored, and your legacy is preserved, no matter what the future holds.

From appointing guardians to safeguarding your child’s financial future, estate planning is an essential step for every new parent. It’s about creating a safety net that spans beyond immediate needs, addressing both the tangible and intangible assets you’ll one day pass on.

Now is the time to take that crucial first step towards securing your family’s future. With over 25 years of dedicated service, The Parents Estate Planning Law Firm has stood by families like yours, guiding them through the complexities of estate planning with compassion and expertise. Our commitment to safeguarding the futures of young families is unwavering.

We understand the unique challenges and concerns that come with new parenthood, and we’re here to ensure that your estate plan reflects your deepest values and aspirations for your loved ones.

Don’t let another day pass without taking action to protect what matters most. Let us help you craft a comprehensive estate plan that secures your legacy and gives you peace of mind.

Ready to take the first step in protecting your family's future?

Download our Kids Protection Planning Guide today and start the journey towards a secure and loving legacy for your child.