As a seasoned parent, you’ve likely already taken some steps to protect your family’s future. But as your children grow and your family dynamics change, it’s crucial to revisit and potentially update your estate plan. At The Parents Estate Planning Law Firm, we specialize in helping families like yours adapt their estate planning strategies. Let’s explore how wills and trusts can address the unique needs of parents with growing children.

The Changing Landscape of Family Estate Planning

Your estate planning needs today are likely quite different from when your children were infants. As your family grows, consider:

- Changing financial circumstances

- Evolving educational needs

- Potential changes in guardianship preferences

- Blended family considerations

- Special needs that may have developed

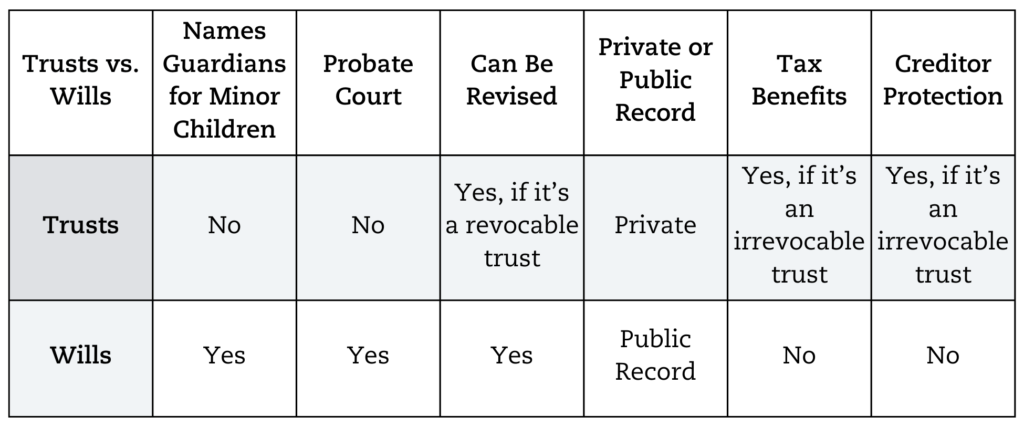

Both wills and trusts can play important roles in addressing these evolving needs, but they do so in different ways.

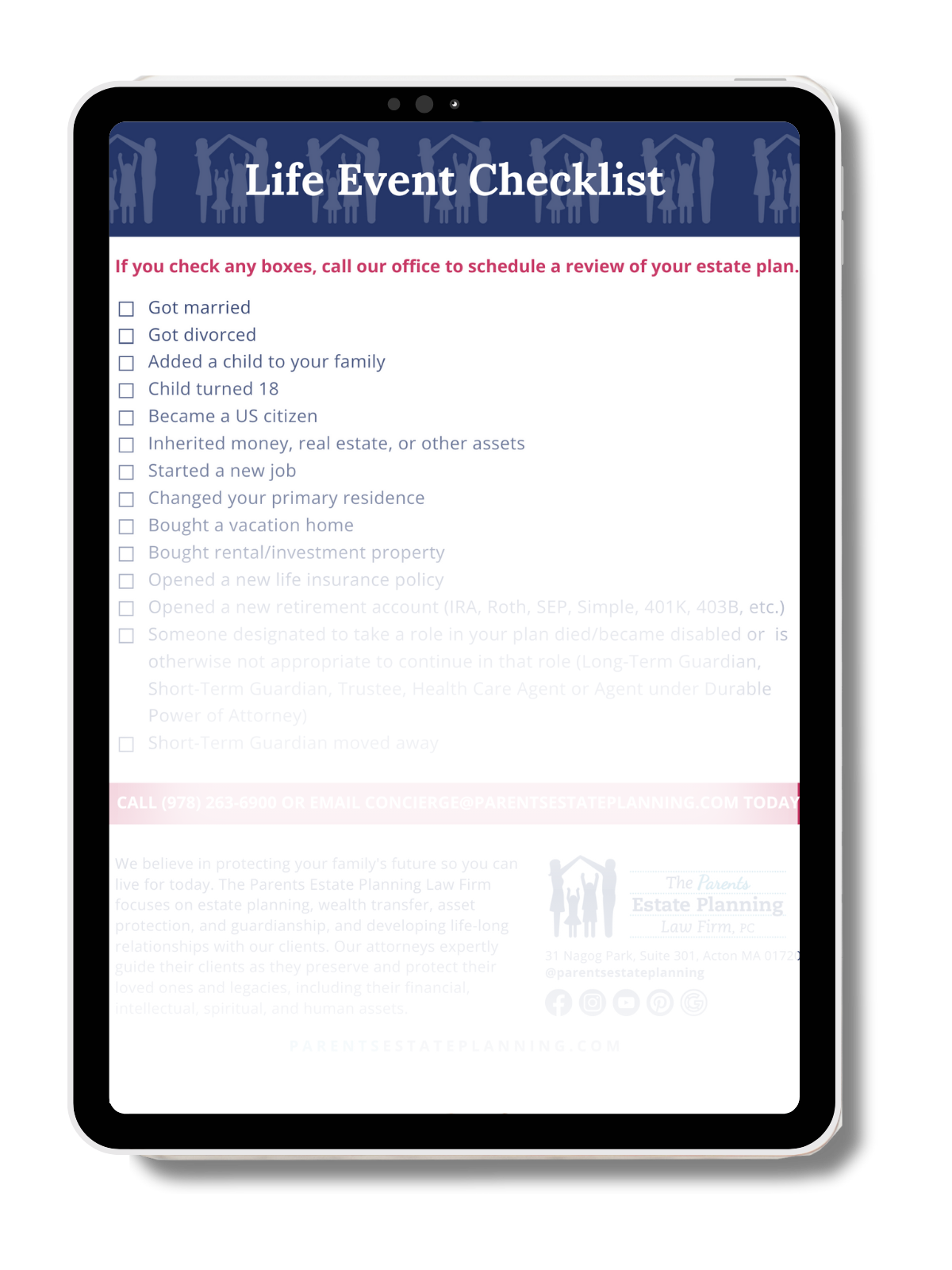

Life changes fast. Is your estate plan keeping up?

Wills: Foundational but Limited

Strengths for Growing Families:

- Allow you to update guardianship choices as your children mature

- Can be easily amended to reflect changes in asset distribution preferences

- Provide a clear roadmap for asset distribution

Limitations for Growing Families:

- Don’t offer ongoing asset management for children

- Become public record through probate, potentially exposing family financial details

- May not adequately address complex family dynamics (e.g., blended families)

Trusts: Flexible and Comprehensive

Advantages for More Experienced Families:

- Can be structured to provide age-appropriate distributions (e.g., partial distribution at 25, full distribution at 30)

- Allow for ongoing asset management, crucial for children who may not be ready to manage an inheritance

- Can include provisions for specific purposes like education funding

- Offer privacy and avoid probate, keeping family matters confidential

Types of Trusts to Consider:

- Revocable Living Trusts: Offer flexibility and can be adjusted as your family’s needs change

- Education Trusts: Specifically designed to fund your children’s education

- Special Needs Trusts: Essential if any of your children have developed special needs

- Blended Family Trusts: Help ensure all children are provided for in complex family structures

Addressing Specific Concerns of Parents with Older Children

Education Planning

- Wills: Can designate funds for education, but offer limited control over how they’re used

- Trusts: Can set specific terms for educational expenses, ensuring funds are used as intended

Blended Families

- Wills: May not adequately protect children from previous relationships

- Trusts: Can be structured to ensure all children are provided for according to your wishes

Asset Protection

- Wills: Offer limited protection against creditors or poor financial decisions

- Trusts: Can include spendthrift provisions to protect assets from creditors or imprudent spending

Business Succession

- Wills: Can transfer business ownership but don’t provide ongoing management

- Trusts: Can include detailed plans for business succession and management

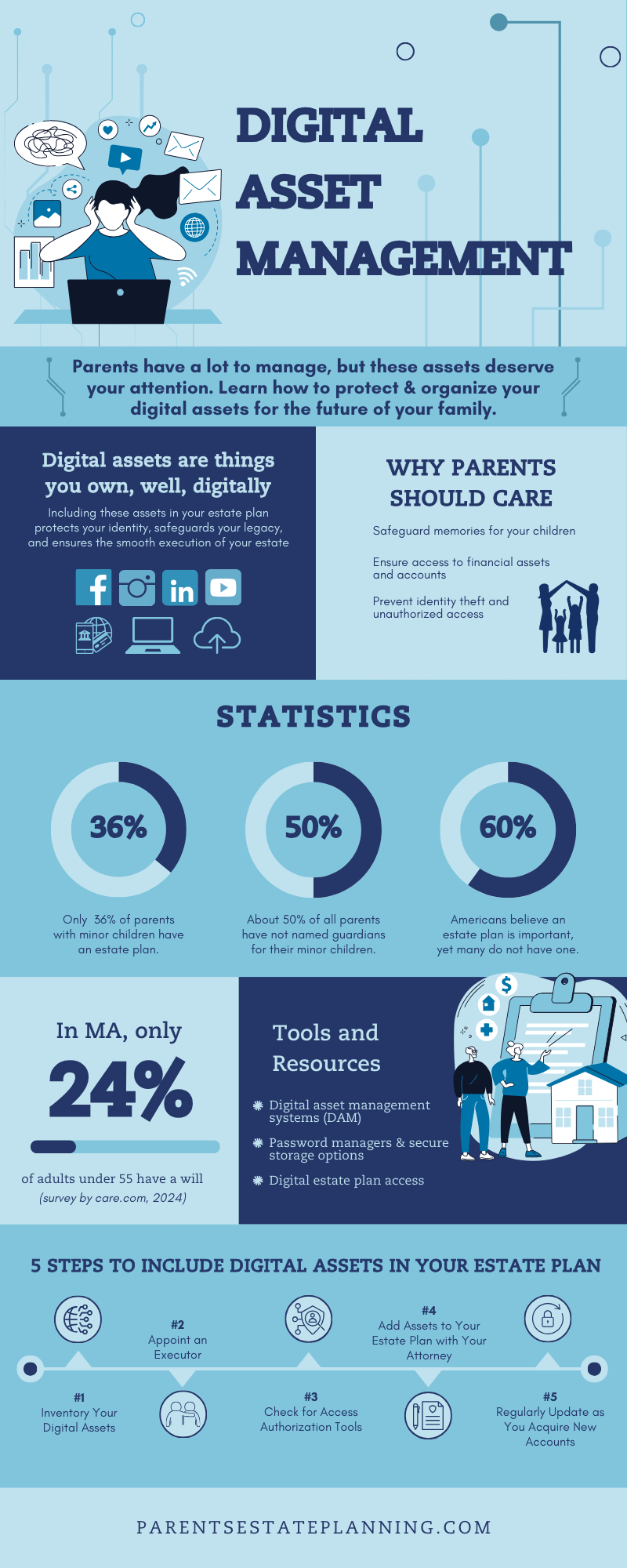

Digital Assets and Online Accounts

As your children grow up in a digital world, consider how to handle digital assets:

- Wills: Can include instructions for digital assets, but may not be immediately accessible

- Trusts: Can provide immediate and private access to digital assets and online accounts

Updating Your Estate Plan: Wills vs. Trusts

Updating a Will:

- Requires a codicil or complete rewrite

- Changes become public record upon death

- May be challenged in court

Updating a Trust:

- Can be amended more easily and privately

- Changes take effect immediately

- Less likely to be challenged successfully

Making the Right Choice for Your Family

As your children grow, your estate plan should evolve with them. While a will may have been sufficient when your children were young, a trust often becomes a more powerful tool as family dynamics become more complex.

At The Parents Estate Planning Law Firm, we understand that every family’s situation is unique. Our Planning Session is designed to help you assess your current needs and create a plan that grows with your family.

Don’t let your estate plan become outdated as your children grow. Contact us today to schedule your Planning Session. Let’s work together to ensure your estate plan continues to provide the best possible protection for your family, now and in the future.