As summer approaches and family travel plans take shape, it’s crucial to consider more than just your itinerary and packing list. Estate planning, often overlooked in the excitement of vacation planning, is a vital step to ensure peace of mind while you’re away. This article will walk you through the essential elements of an estate planning vacation checklist to complete before you embark on your summer adventures.

Why Estate Planning is Crucial Before Vacation

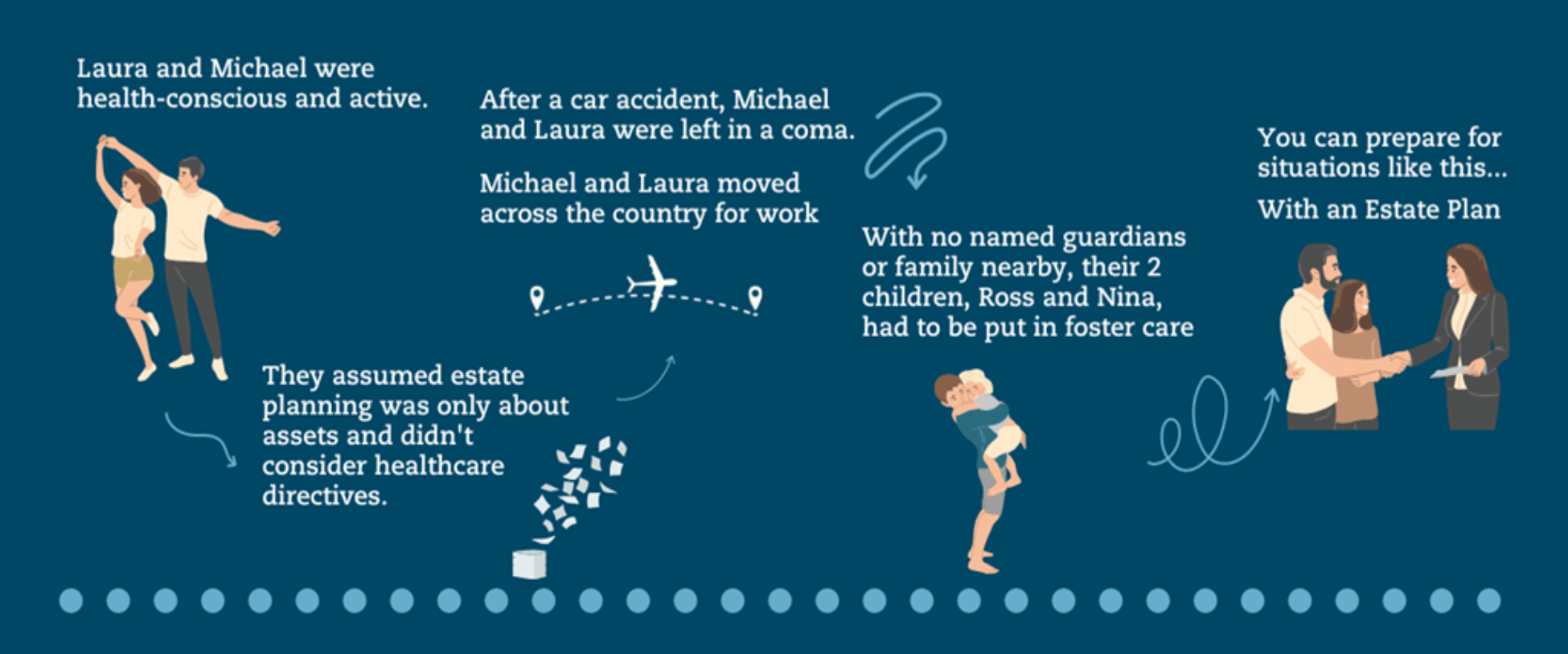

Estate planning before vacation is important for several reasons. It provides peace of mind, knowing that your affairs are in order should anything unexpected occur. It also protects your loved ones by clearly outlining your wishes and designating decision-makers in case of emergencies. Additionally, having a comprehensive estate plan in place can help avoid legal complications and ensure your assets are distributed according to your desires.

Your Pre-Vacation Estate Planning Checklist

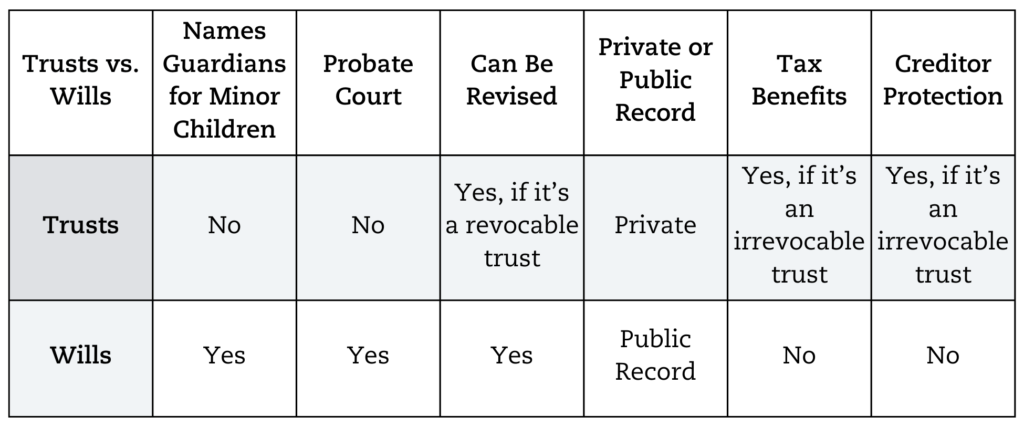

1. Review and Update Your Will

A will is the cornerstone of any estate plan. Before your vacation, ensure your will is up-to-date and reflects your current wishes:

- Verify beneficiary designations

- Update guardian appointments for minor children

- Ensure all assets are accounted for

2. Establish or Update Your Trust

Consider setting up a trust or reviewing your existing one. Trusts offer more control over asset distribution and can help avoid probate. This is particularly important if you’re traveling for an extended period or internationally.

3. Designate Powers of Attorney

Before your vacation, ensure you have both financial and healthcare powers of attorney in place:

- Durable Power of Attorney: Allows someone to manage your finances if you’re incapacitated.

- Health Care Proxy: Also known as a health care power of attorney. Designates someone to make medical decisions on your behalf.

4. Create Advance Healthcare Directives

As part of your estate planning vacation checklist, include:

- Living will: Specifies your end-of-life care wishes.

- HIPAA authorization: Allows healthcare providers to share your medical information with designated individuals.

5. Review Beneficiary Designations

Check and update beneficiary designations on:

- Life insurance policies

- Retirement accounts (401(k)s, IRAs)

- Other financial accounts

6. Plan for Minor Children

If you have minor children, your estate planning vacation checklist should include:

- Designating temporary short-term guardians while you’re away

- Ensuring your will includes long-term guardianship provisions

Taking a parents-only vacation?

Make sure your Sitter is prepared.

7. Organize Financial Documents and Accounts

Before your vacation:

- Create an inventory of all your assets.

- Secure important documents in a safe place.

- Provide access information to trusted individuals.

- Place your estate plan in a visible, easily accessible location.

8. Review and Update Insurance Policies

Ensure your insurance coverage is adequate for your trip:

- Life insurance

- Travel insurance

- Health insurance (especially for international travel)

9. Discuss Your Plans with Loved Ones

Open communication about your estate plan is crucial:

- Inform key individuals about their roles (executors, trustees, guardians)

- Discuss your wishes and the reasoning behind your decisions

Next Steps: Implementing Your Estate Planning Vacation Checklist

Before You Consider Online Estate Planning Tools

While the convenience and lower cost of online estate planning tools may seem appealing, they come with significant risks that can jeopardize the effectiveness of your estate plan. Here are some key concerns:

Lack of Legal Expertise:

Online platforms often lack the personalized legal advice that a qualified estate planning attorney can provide. This can lead to documents that do not comply with state-specific laws and regulations, potentially rendering them invalid.

Inadequate Customization:

Estate planning is a highly individualized process. Online tools typically use standardized templates that may not address your unique family dynamics or financial situation, leading to incomplete or flawed plans.

Ambiguity and Misinterpretation:

The language used in online documents can be vague or open to misinterpretation, increasing the likelihood of disputes among beneficiaries.

Security Concerns:

Submitting sensitive personal and financial information online can expose you to security risks, including data breaches and identity theft.

Lack of Updates and Compliance:

Estate laws change over time, and online services may not keep your documents up-to-date with the latest legal requirements, potentially causing issues during probate.

Given these risks, it is advisable to seek professional guidance to ensure your estate plan is comprehensive, legally sound, and tailored to your specific needs.

Need an estate planning attorney?

Ask these 10 questions before you hire them.

Consult with an Estate Planning Attorney

An experienced estate planning attorney can provide valuable guidance tailored to your specific situation. Our team at The Parents Estate Planning Law Firm can help ensure your documents are legally sound and comprehensive.

Don’t leave for your summer vacation without securing your legacy. Start your estate planning process today to ensure a worry-free travel experience and protect your loved ones’ future.

Remember, completing this estate planning vacation checklist isn’t about dwelling on worst-case scenarios. It’s about caring for your loved ones and giving yourself the freedom to fully enjoy your vacation, knowing you’ve taken care of important matters at home.

So go ahead, check off these items, and then focus on the exciting adventures ahead. Safe travels, and may your vacation be filled with joy, relaxation, and wonderful memories!