Welcome to the exciting journey of financial planning in your 30s. While retirement might seem like a distant dream, it is so important to lay the groundwork now to set you up for a future of financial freedom. In this article, we’ll explore the key strategies for retirement planning in your 30s. We will also focus on the importance of starting early and making informed decisions to secure your financial future.

Retirement Planning In Your 30s - Starting Early:

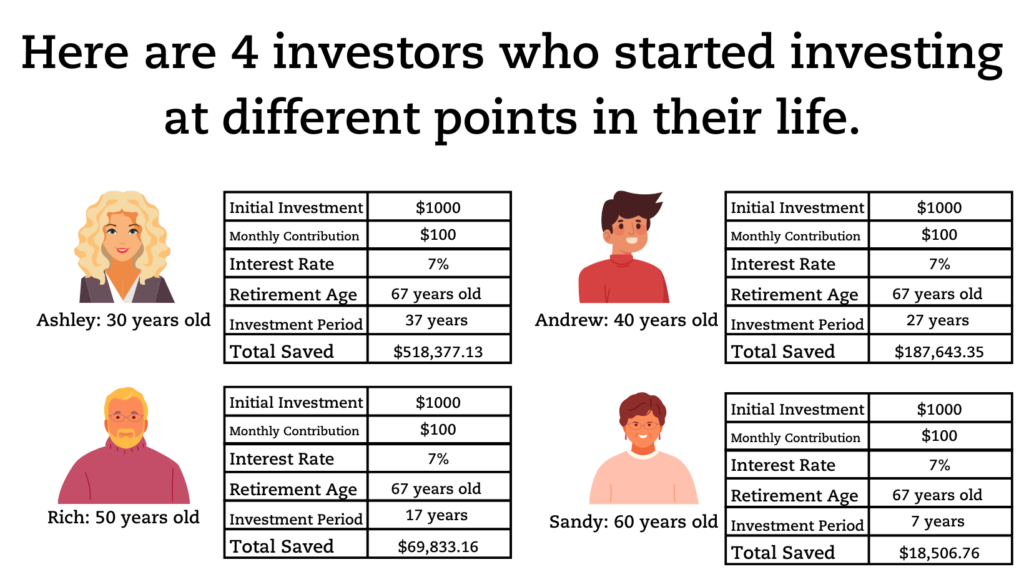

They say the early bird catches the worm, and the same holds true for retirement planning. Even in your 30s, you have a significant advantage in building a comfortable retirement fund. By starting early, you give yourself time to take advantage of compounding returns, allowing your investments to grow steadily over time. Look at these investors to get a better idea of how advantageous saving sooner is for the long run!

Savings Milestones:

Setting savings milestones is essential for tracking your progress towards retirement. By age 30, aim to have the equivalent of one year’s salary saved, and by age 40, three times your annual pay. These benchmarks can serve as tangible goals to strive for, motivating you to stay on track with your savings efforts. These benchmarks can also serve as a reason to celebrate with your spouse! Saving doesn’t have to be all business! Reward yourself for reaching your goals, maybe dinner at that restaurant you’ve been wanting to try or finally making that appointment for a massage, you deserve it.

Set Expectations:

Take some time to envision your ideal retirement lifestyle. Whether it involves traveling the world, pursuing passions you had to keep in the backseat during your career, or downsizing to a simpler life, aligning your retirement strategy with your expectations is crucial. Visualizing your future can help you determine the size of your nest egg and set realistic savings targets.

"Pay Yourself First" Strategy:

Automate contributions to your retirement accounts to ensure consistent savings. By prioritizing your retirement savings and setting up automatic deposits, you make it easier to stay on track with your financial goals. Budgeting can also help you allocate funds for essential expenses while still making room for retirement savings. Your future self will thank you!

Imagine the peace of mind you’ll have, knowing that your retirement is secure. This will set you up for success in achieving your goals without the stress of manual payments. Your future self will thank you for being thoughtful now. According to a vanguard report, the average retirement savings rate rose due to automatic payments.

Windfall Management:

Use unexpected cash windfalls wisely to boost your retirement savings or emergency fund. While it’s tempting to splurge on luxury items, allocating a portion of windfall funds towards your long-term financial security can yield significant benefits. By making strategic decisions with windfall money, you reinforce your commitment to achieving your retirement goals or even surpass them! Who knows, you could be setting yourself up for an early retirement.

A survey from the National Endowment for Financial Education reported that more than 70 percent of lottery winners end up bankrupt within just a few years after receiving their windfalls. People who inherit large sums all at once may struggle to maintain their newfound wealth over time. Careful planning and management when dealing with unexpected financial windfalls is essential.

Your Estate Plan

Estate planning is crucial to your retirement plan. It ensures that assets are distributed according to one’s wishes after death, providing peace of mind and security for yourself and loved ones. By establishing a comprehensive estate plan, you can minimize taxes and legal fees, preserving more wealth for retirement and future generations.

Additionally, estate planning allows you to appoint trusted individuals to manage your finances and make healthcare decisions in the event of incapacity, ensuring a smooth transition and protecting interests during retirement years. Overall, integrating estate planning into your retirement strategy offers financial stability, protects assets, and facilitates the fulfillment of personal legacies.

Planning for retirement in your 30s is an exciting opportunity to take control of your financial future. By starting early, setting clear goals, and making informed decisions, you can build a solid foundation for a comfortable and fulfilling retirement. Remember to leverage tools and resources, such as retirement calculators and investment accounts, to optimize your savings strategy. With careful planning and disciplined saving habits, you can turn your retirement dreams into a reality.