While National Make-a-Will Month highlights the importance of having a will, it’s crucial to understand that a will is just the first step in creating a comprehensive estate plan. A complete plan protects you and your loved ones during your lifetime and beyond.

Lifetime Protection: Planning for the Unexpected

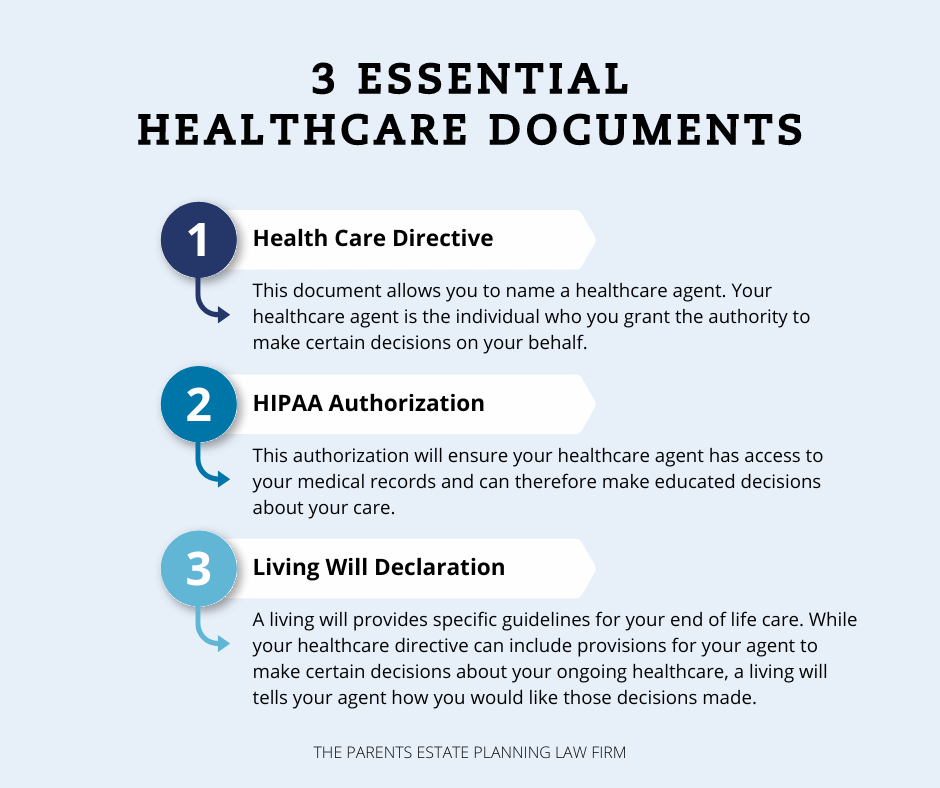

A will primarily addresses what happens after you die, but it doesn’t account for scenarios where you’re alive but unable to make decisions. Other essential documents that address these matters include:

- Power of Attorney: Designates someone to make financial and legal decisions if you’re incapacitated.

- Healthcare Directive: Outlines your wishes for medical treatment if you can’t communicate them.

- HIPAA Authorization: Gives designated representatives access to your medical information

These documents ensure your wishes are respected even if you can’t express them directly.

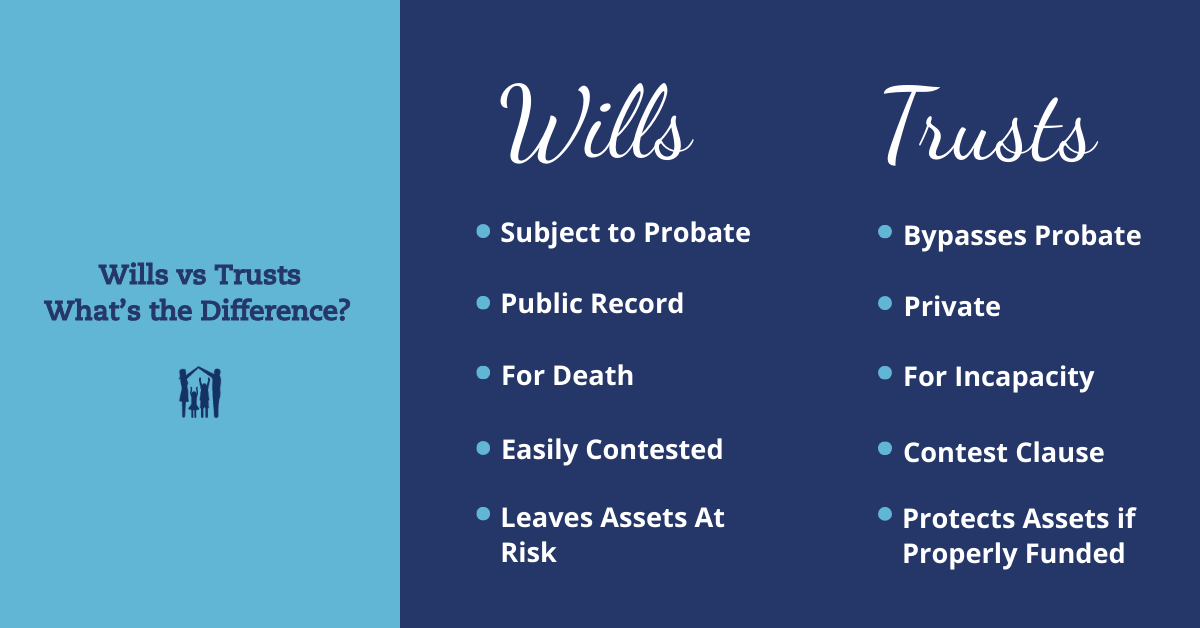

Enhanced Control: The Role of Trusts

A trust can provide even more control over your affairs:

- Avoiding Probate: Assets in a trust typically bypass the often lengthy and costly probate process.

- Increased Privacy: Trusts are not public records, unlike wills.

- Greater Control: Set specific conditions for asset distribution.

- Potential Tax Benefits: Certain trusts can help minimize estate taxes.

Creating Your Comprehensive Estate Plan

Remember, estate planning isn’t one-size-fits-all. Your plan should be tailored to your unique situation. While creating a will is an excellent first step, consider how a more comprehensive estate plan could benefit you and your loved ones.

Don’t hesitate to reach out if you need guidance in creating your complete estate plan. We’re here to help ensure your wishes are honored and your loved ones are protected, no matter what life brings.