Congratulations on becoming a grandparent! This exciting new chapter brings immense joy and new responsibilities. At The Parents Estate Planning Law Firm, we understand that you want to ensure your family’s future is secure. Let’s explore how wills and trusts can help you protect your grandchildren and manage your estate effectively.

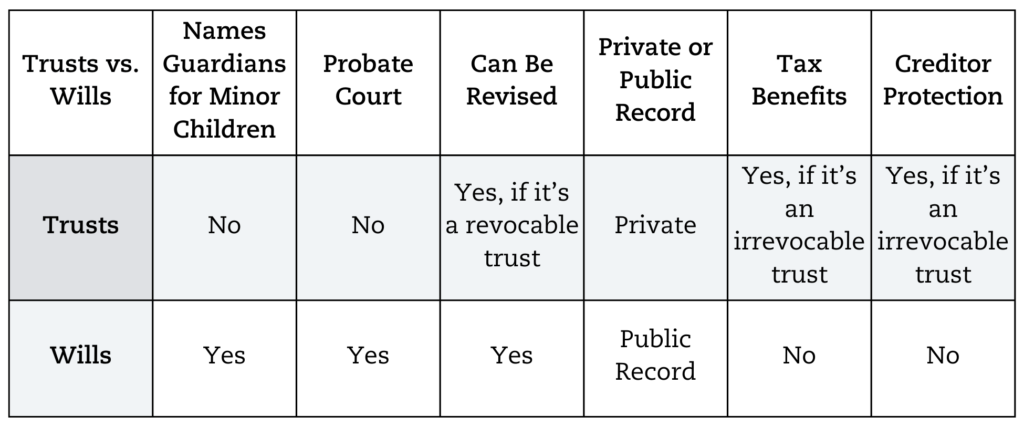

Understanding Wills and Trusts: Key Differences

Wills:

- A legal document that specifies how your assets should be distributed after your death.

- Allows you to designate beneficiaries and outline your wishes.

- Requires probate, which is a public court process.

Trusts:

- A legal arrangement that can take effect immediately upon creation.

- Manages and holds assets for the benefit of your beneficiaries.

- Bypasses probate, offering privacy and potentially quicker distribution.

Activation: Timing Matters

For new grandparents, the timing of when these documents take effect is crucial. Wills only become active after your death and do not provide assistance if you become incapacitated.

In contrast, trusts take effect as soon as they are created and funded, allowing them to manage your assets if you become incapacitated and ensuring your wishes are followed without court intervention.

This immediate activation of trusts can be particularly beneficial in managing your assets and providing for your grandchildren during your lifetime.

Asset Management: Flexibility and Control

Trusts, on the other hand, include any assets transferred into them and can be updated with new assets over time.

This flexibility allows you to ensure that your grandchildren’s needs are met and that your assets are managed according to your wishes.

Think you’ve chosen the right attorney? Think again.

Administration: Privacy and Efficiency

Wills must go through probate, which can be a lengthy and public process, potentially leading to delays and additional costs for your beneficiaries.

Trusts, however, avoid probate, allowing for private and quicker administration of your assets and ensuring that your family’s financial matters remain confidential.

For new grandparents, the privacy and efficiency of trusts can be significant advantages, ensuring that your estate is managed smoothly and discreetly.

Providing for Grandchildren: Tailored Solutions

As a grandparent, you want to ensure that your grandchildren are well taken care of. Trusts offer unique advantages in this regard:

- Education Trusts: Allocate funds specifically for your grandchildren’s education, ensuring they have the resources they need for their future.

- Generation-Skipping Trusts: Efficiently transfer wealth across generations, minimizing tax implications.

- Spendthrift Trusts: Protect assets from being mismanaged by younger beneficiaries, providing financial oversight and stability.

Making the Right Choice for Your Family

Every family is unique, and your estate plan should reflect your specific circumstances and goals. At The Parents Estate Planning Law Firm, we specialize in helping new grandparents create comprehensive estate plans that provide for their loved ones and secure their legacy.

Ready to ensure your estate plan reflects your new role as a grandparent? Schedule a Planning Session with us today. Let’s work together to create a plan that protects your assets, honors your wishes, and secures your family’s future for generations to come. By converting the specified sections into sentences, the article for new grandparents should now be more distinct and engaging, while still focusing on the wills vs. trusts theme.