As your children spread their wings and leave the nest, it’s time to revisit your estate plan. Your life has changed, and your estate plan should reflect that. At The Parents Estate Planning Law Firm, we understand the unique challenges and opportunities that come with this new chapter of your life. Let’s explore how wills and trusts can work for you in this exciting phase.

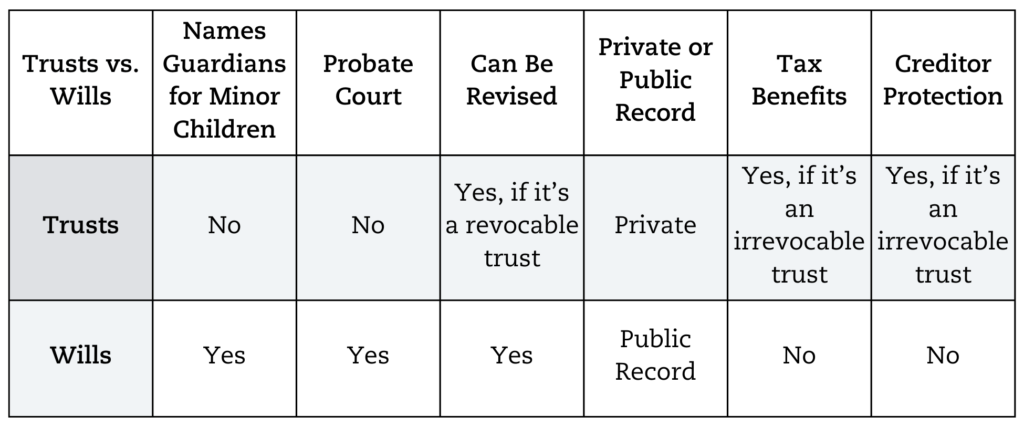

Wills vs. Trusts: The Basics

Wills:

- A legal document that takes effect after you pass away.

- Directs how your assets should be distributed.

- Must go through probate, a public court process.

Trusts:

- A legal entity that can take effect immediately.

- Holds and manages assets for beneficiaries.

- Avoids probate, offering privacy and potentially faster distribution.

When They Take Effect: Planning for Now and Later

While a will only springs into action after you’ve passed, a trust can start working for you right away. For empty nesters like you, this difference is crucial.

Wills become effective only upon your death. However, they don’t provide protection if you become incapacitated.

Trusts, on the other hand, take effect as soon as they’re signed and funded. A strategic estate plan allows you to effectively manage your assets, even if you become incapacitated.

A trust offers the added benefit of managing your assets during your lifetime, providing peace of mind in case of incapacity.

The Assets They Cover: Protecting What Matters

Your home, your savings, your cherished possessions – you’ve worked hard for these, and you deserve to decide what happens to them.

Wills cover assets solely in your name, but don’t include jointly owned property or assets with designated beneficiaries.

Trusts can include any assets you transfer into them. This flexibility allows for more comprehensive asset management and distribution according to your wishes.

This means your home, savings, and other important assets can be managed and distributed as you see fit, providing financial stability for your loved ones.

Empty nest? Your estate plan might have holes.

Administration: Probate vs. Private Management

Wills require probate – a public, often lengthy court process. This can lead to delays and additional costs.

On the other hand, trusts allow for private and quicker administration of your assets. Your family would avoid probate, which means your assets are handled swiftly and privately.

For empty nesters, the privacy and efficiency of trusts can be significant advantages, ensuring your assets are managed without the delays and costs associated with probate.

Costs: Upfront vs. Long-Term Savings

While wills are less expensive upfront, the costs of probate can add up.

Trusts may require a higher initial investment but can save money in the long run by avoiding probate fees.

Investing in a trust might be a wise decision for empty nesters to ensure long-term financial security.

Updating Your Existing Plan: A Fresh Start

Now that your children are adults, your estate plan likely needs a refresh. Those guardianship clauses you carefully crafted years ago? It’s time to bid them farewell. But don’t worry – we’re here to help you navigate these changes with ease and confidence.

Key updates to consider:

- Removing outdated guardianship provisions

- Reviewing and updating beneficiary designations on retirement accounts and life insurance policies

- Reassessing your overall estate distribution strategy

Find the Right Option for Your Family

Every family is unique, and your estate plan should be too. At The Parents Estate Planning Law Firm, we specialize in creating personalized estate plans that give you peace of mind and security for your future.

Ready to ensure your estate plan reflects your empty nester status? Schedule a Planning Session with us today. Let’s work together to create a plan that protects your assets, honors your wishes, and secures your legacy.