That’s something that we do with our clients on a fairly regular basis. It’s not something you want to try on your own but you want to work with an attorney who works in with trusts and names trusts as beneficiaries on a regular basis to make sure it gets set up properly.

Understanding Incapacity

Mental Incapacity

Physical Incapacity

To learn about the leading causes of disability, checkout this article from MedicineNet.

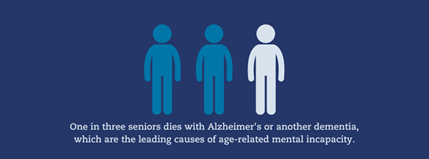

Age-Related Incapacity

Preparing for potential age-related incapacities through proper legal planning gives you control over your latter life care. The same 2024 statistical resource stated that more than 11 million Americans provide unpaid care for a family member or friend with dementia. If you plan ahead you could provide funds for this type of care if necessary.

The Importance of Incapacity Planning

The consequences of incapacity can be devastating if you have not established the proper legal arrangements in advance. Without documented instructions, you could be subjected to costly court guardianship proceedings where a stranger makes decisions about your care and assets. Proper incapacity planning allows you to nominate people you trust to carry out your wishes if you become incapacitated.

By understanding the realities of incapacity and taking proactive legal steps, you ensure your affairs will be managed properly by those you trust most if you can no longer make decisions for yourself. Incapacity planning provides invaluable peace of mind that your future care aligns with your values and priorities.

Legal Documents for Incapacity Planning

Durable Power of Attorney for Finances

One of the most crucial legal documents for incapacity planning is a durable power of attorney (POA) for finances. This powerful instrument allows you to nominate someone you trust to manage your financial affairs if you become incapacitated and unable to make decisions for yourself.

Legal Documents for Healthcare and End-of-Life Decisions

Health Care Proxy

Living Will

A Living Will, also called an advance healthcare directive, works alongside your Healthcare Proxy by documenting your end-of-life preferences. Within this legal instrument, you can specify your desires regarding life-sustaining measures like:

- Resuscitation if you stop breathing or your heart stops

- Use of a ventilator for breathing assistance

- Tube feeding for artificial nutrition

- Palliative or hospice care

HIPAA Release

Durable Power of Attorney

Choosing Agents/ Representatives

Powers Granted

- Banking and investment transactions

- Managing retirement accounts

- Paying bills and filing taxes

- Buying, selling, or mortgaging real estate

- Operating a business, you own

- Handling government benefit

- Making gifts or transferring assets

- Hiring professional assistance (accountants, lawyers, etc.)

Criteria for Selecting Your Agents

Your ideal candidate should have strong decision-making abilities, organizational skills, and be able to advocate on your behalf in difficult situations.

Many people choose close family members like a spouse, adult child or sibling. Relatives are not obligatory choices – a very close friend, spiritual advisor or professional fiduciary could also be well-suited if they deeply understand your values and preferences.

Duties and Responsibilities of Agents

Trustees (if you have a revocable living trust) are fiduciaries obligated to administer and distribute trust assets according to the trust document’s terms for your benefit.

Potential Conflicts of Interest

Long-Term Care Planning

As we age, the likelihood of needing some form of long-term care increases substantially. Planning for this potential need is crucial to protect your assets and ensure you can access quality care aligned with your wishes.

Evaluating Long-Term Care Needs and Costs

The first step is candidly assessing your individual risk factors and estimating future long-term care costs. This evaluation should consider:

- Your current age and life expectancy

- Family health history and existing medical conditions

- Likelihood of requiring home care, assisted living or nursing home

- Projected costs in your area for different care settings

- Availability of potential family caregivers

High price tags combined with the likelihood of requiring long-term care make strategic estate planning a crucial step to avoid depleting your life savings on these expenses.

Medicaid Planning Strategies

If your assets are modest, Medicaid is likely your primary payer for long-term care. However, strict income and asset rules must be followed to qualify.

Proper Medicaid planning can help protect your home and life savings from being completely depleted by care costs.

You might include strategies like establishing an irrevocable income-only trust, making specific exempt transfers, or converting assets to Medicaid-compliant annuities. With the help of an estate planning attorney, there are other strategies you can look into as well.

However, there are look-back periods and penalties for transferring assets improperly before applying, so advanced planning is essential.

Long-Term Care Insurance Options

Disadvantages of Court-Appointed Guardians

In Massachusetts, having a court appoint a guardian or conservator to manage your affairs if you are incapacitated comes with several disadvantages:

- Court costs like filing fees can quickly exceed $1,000

- Court-appointed guardians may not have the same understanding of your values, wishes and best interests as someone you pre-select.

- The process can also be expensive, public, and create family conflicts.

How Proper Incapacity Planning Avoids Court

- Proper incapacity planning allows you to nominate people you trust to carry out your wishes if you become incapacitated. It safeguards your independence, dignity, and finances during a vulnerable time.

- Writing a will and naming the special needs trust as the beneficiary, rather than your child directly, protects their access to public assistance programs.

- With a properly drafted durable POA for finances, you ensure someone you explicitly select, and trust will have the legal ability to properly manage your financial life if you are ever unable to do so yourself.

Reviewing and Updating Plans

- Marriage or divorce

- Birth or adoption of a child

- Child becoming an adult

- Death of a spouse, child, or other beneficiary

- Inheritance or significant change in assets

- Moving to a new state

- Changes in tax laws or Medicaid regulations

Don’t leave your future to chance. You can start to take control by scheduling a call with our firm. We’ll guide you through creating the essential legal documents like a durable power of attorney, living will, and revocable trust to ensure your wishes are carried out if you become incapacitated. Protect your independence, dignity and assets by creating your incapacity plan.